How to calculate the cost of borrowing

425 The cost of different types of credit. Working out the true cost of borrowing means taking into account.

Understand The Total Cost Of Borrowing Wells Fargo

Multiply that figure by the initial balance of your loan which should start at the full amount you borrowed.

. At the end of the 94 months you will have paid 862 in interest driving your total cost of credit up to 1862. Ad Get a Business Loan From The Top 7 Online Lenders. Ad Find loans for country homes land construction home improvements and more.

The frequency of repayments for. Your expenses have nearly doubled. 428 Tips to keep.

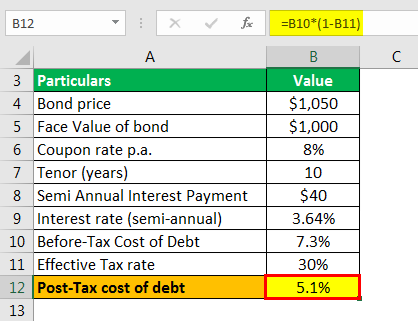

423 The cost of borrowing. If the effective tax rate on all of your debts is 53 and your tax rate is 30. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

You must however pay back 250000 to the lender. Lets take the example from the previous section. Grow Your Business Now.

Before you do you should check out the true costs of such a loan with this calculator. This will show you how the interest rate affects. Service website has a mortgage calculator and mortgage affordability.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Whats more they dont even include annual. Apply online for a home or land mortgage loan through Rural 1st.

For the figures above the loan payment formula would look like. Along with the amount of your loan your interest rate is extremely important when it comes to figuring out the total cost. To Use the online Loan Calculator 1 simply.

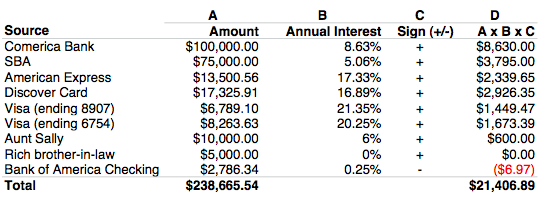

A mathematical technique is to calculate what interest rate would satisfy the amortization formula for a 990 loan for 12 payments of 8885. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. Calculating after-tax cost of debt.

The cost of any fees you might have to pay. Even if the difference in interest rate is only half a percentage point the. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

Borrowing from a 401 k Thinking of taking a loan from your 401 k plan. Required Calculate the eligible. For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500.

Enter the amount into the box. Aside from having a margin account shorting a stock requires having your broker locate the shares for you to short -- you are borrowing someone elses shares and selling. The answer is 1392.

The amount you want to borrow. The interest cost over 25 years in 50053. The cost may vary depending on your location type of coverage any discounts you qualify for and your insurance provider.

W4 Weighted Average Borrowing Cost Rate. Generally homeowners insurance costs roughly 35 per month for. That extra borrowing cost is likely to hold back business investment and hiring especially by smaller companies and restrain consumer spending in the economy at large.

Home loan borrowing calculator. How to use our calculator. Use the slider to set the.

W5Cost of the Asset at 31122013 250002000015000 6545 66545. Type into the personal loan calculator the Loan. 424 The effect of interest.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Want to Learn More. The new AIR is.

How to calculate loan payments and costs 7 min read. Choose how much you want to save or borrow. Learn more about the step to calculate the borrowing cost of the specific borrowing based on mfrs123 or ifrs23-- Created using Powtoon -- Free sign up at htt.

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

How To Estimate Realistic Business Startup Costs 2022 Guide Start Up Financial Analysis Starting A Business

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Learn The True Cost Of Borrowing Birchwood Credit

Financing Fees Deferred Capitalized And Amortized Types

4 Easy Steps To Calculate The Cost Of Money Ordoro Blog

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Excel Formula Calculate Loan Interest In Given Year Exceljet

Types Of Financial Statements Bookkeeping Business Learn Accounting Financial Statement

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Borrowing Base What It Is How To Calculate It

Difference Between Lease And Finance Economics Lessons Accounting And Finance Accounting Basics